Average College Tuition [2023-2024]

Average Cost of College: Understanding Tuition and Fees for 2023-2024

The cost of attending college in the United States encompasses more than just tuition. It includes books, supplies, and daily living expenses, averaging $36,436 per student annually. This figure has risen sharply over time, more than doubling since the start of the 21st century.

With an annual increase of around 2% over the past decade, funding a college education poses a significant financial challenge to many students and families. The expenses diverge considerably between public and private institutions as well as in-state and out-of-state attendances, impacting the financial planning of prospective students.

Moreover, the sticker price of tuition does not fully encapsulate the true cost of a college education. When factoring in additional elements like student loan interest and the opportunity cost of income not earned during years spent studying, the total investment for a bachelor's degree may well exceed half a million dollars.

This substantial sum reflects the high value and importance placed on higher education in today's economy. It also underscores the necessity for students to make well-informed financial decisions about their educational paths.

Key Takeaways

- College costs include tuition, books, and living expenses, averaging $36,436 per student per year.

- Annual costs vary widely between public and private institutions and whether students are in-state or out-of-state.

- True educational expenses extend beyond tuition to include loan interest and potential lost income.

Comprehensive Overview of College Education Costs

Overview of Annual and Aggregate College Tuition

College tuition represents a significant portion of a student's education expenses. The annual average cost for attending a four-year institution is just under $20,000, amounting to a bit over half of the aggregate college costs.

Public universities offer more affordable in-state tuition, which hovers around $9,700 per annum, accounting for roughly a third of total attendance costs. Conversely, private non-profit universities have an average annual tuition near $39,000, claiming two-thirds of the student's education expenses. Private for-profit institutions show a similar percentage of expenses with their annual tuition averaging around $17,800.

Two-year institutions present a lower financial threshold with an average cost of just under $4,500 in tuition and fees, a quarter of the total cost for students attending these colleges. Public community colleges provide the most affordable option with in-district fees averaging just below $4,000.

Trends in Tuition Over Time

Tuition costs have escalated considerably over the past several decades. Adjusting for inflation, the annual cost of tuition experienced at a public four-year college in 1963 would be equivalent to about $2,430 in recent years. This amount has seen an inflation-adjusted increase by an average of 2.5% yearly up to 2020.

The decade starting 2010 saw a 17% hike at two-year colleges and a steeper 45% climb at public four-year institutions for in-state tuition, with private non-profit four-year colleges increasing by 28%. This tuition inflation has far exceeded the wage inflation over the same period, marking a 111.4% differential.

Costs for Textbooks and Scholarly Materials

The financial demands of college extend into the realm of textbooks and supplies. On average, students at public four-year colleges will spend more than $1,200 annually on these materials. This figure remains consistent across private non-profit and for-profit institutions. Public two-year colleges typically see a higher average expense for books and supplies, costing students about $1,440 per year.

Housing and Meal Plan Expenditures

Room and board, variable based on residency status, contribute significantly to college costs. Average annual expenses for on-campus living at a four-year institution are just over $12,000.

Public university students living on campus can anticipate costs around $11,520, slightly less if opting to live off-campus. Private institutions of the non-profit variety see on-campus costs surpassing $13,000 annually, with off-campus living costs marginally less. For-profit colleges present a higher on-campus room and board average, substantially decreasing for students choosing off-campus living arrangements.

At two-year colleges, expected room and board costs average just above $7,000 for on-campus living and up to $10,200 for off-campus accommodations.

Outlay for Additional Necessities

Beyond books and housing, students encounter a broad range of supplementary expenses that can include personal care, entertainment, and transportation. These costs vary based on several factors such as locality and living arrangements.

An on-campus resident at a public four-year college can expect to pay over $3,300 in additional expenses annually, which increases for off-campus students not residing with family. Private institution students, both non-profit and for-profit, also face these additional costs; however, for-profit on-campus dwellers see the highest average at over $5,200.

Two-year college students are not exempt from these ancillary costs, which can average between $3,500 and $4,500 depending on their living situation.

Public College Tuition and State Residency

The state in which a college is located largely influences tuition costs. Residents often benefit from lower in-state tuition rates at public institutions.

Financially, this can mean a significant difference across states, with public university students in some states such as New York or California receiving more favorable rates, while students in other states like New Hampshire or Pennsylvania might face higher costs.

The disparity between in-state and out-of-state tuition can be substantial, making residency a critical factor for potential enrollees to consider.

| State | Tuition & Fees | Tuition + Room & Board |

|---|---|---|

| Vermont | $17,593 | $30,752 |

| New Hampshire | $16,749 | $29,222 |

| Illinois | $14,579 | $26,252 |

| Pennsylvania | $14,532 | $26,040 |

| Connecticut | $14,487 | $28,425 |

| New Jersey | $14,184 | $28,335 |

| Massachusetts | $13,939 | $28,317 |

| Virginia | $13,931 | $25,761 |

| Michigan | $13,716 | $24,777 |

| Rhode Island | $13,697 | $26,946 |

| South Carolina | $12,544 | $23,181 |

| Minnesota | $11,836 | $21,858 |

| Oregon | $11,537 | $24,517 |

| Arizona | $11,410 | $24,681 |

| Delaware | $11,343 | $24,862 |

| Kentucky | $10,976 | $22,317 |

| Alabama | $10,617 | $20,993 |

| Maine | $10,377 | $20,677 |

| Tennessee | $10,271 | $20,639 |

| Hawaii | $10,197 | $22,012 |

| Ohio | $10,049 | $22,860 |

| Indiana | $9,656 | $20,572 |

| Louisiana | $9,656 | $20,031 |

| Maryland | $9,401 | $22,380 |

| Iowa | $9,373 | $19,788 |

| Missouri | $9,310 | $19,394 |

| Colorado | $9,269 | $22,288 |

| Kansas | $9,081 | $19,082 |

| North Dakota | $9,065 | $18,057 |

| South Dakota | $9,012 | $17,177 |

| Alaska | $8,849 | $22,185 |

| Wisconsin | $8,782 | $17,875 |

| Nebraska | $8,761 | $19,352 |

| Mississippi | $8,642 | $19,221 |

| Arkansas | $8,468 | $18,262 |

| New York | $8,416 | $24,231 |

| California | $8,401 | $24,015 |

| West Virginia | $8,252 | $19,312 |

| Oklahoma | $8,064 | $17,283 |

| Texas | $8,016 | $18,325 |

| Georgia | $7,525 | $18,711 |

| Washington | $7,485 | $21,027 |

| Idaho | $7,482 | $16,518 |

| New Mexico | $7,393 | $17,113 |

| North Carolina | $7,260 | $17,113 |

| Montana | $6,993 | $16,931 |

| Utah | $6,764 | $14,653 |

| Nevada | $6,434 | $18,065 |

| District of Columbia | $6,152 | Unavailable |

| Wyoming | $4,785 | $14,584 |

| Florida | $4,541 | $15,543 |

| National Average | $9,375 | $21,337 |

Evaluation of On-Campus versus Off-Campus Costs

Room and board differ notably between on-campus and off-campus living situations. While on-campus residency generally includes preset meal plans and fewer transportation expenses, off-campus living might offer more personal freedom and potential savings depending on local housing markets.

Students must weigh the convenience of on-campus living against the potential financial advantage that off-campus residences could offer, taking into account their unique preferences and fiscal situation.

Financial Aid and Education Expenditure

The landscape of higher education funding incorporates multiple financial elements such as scholarships, grants, loans, and student debt. Detailed data on these facets are collected and disseminated by entities like the National Center for Education Statistics.

Particularly, comprehensive education statistics offer insights into evolving patterns of education financing and the ramifications on student debt.

Key Elements:

- Scholarships and Grants: Non-repayable forms of student aid that alleviate college expenses.

- Loans: Borrowed funds requiring repayment with interest. Data suggest private student loans often bear higher interest rates.

- Debt: The financial burden that may persist post-graduation, impacting long-term financial well-being.

- Labor Market: Post-college employment statistics that inform the feasibility of loan repayment.

Financial Aid Resources:

- The College Board and the Department of Education provide tools for post-secondary funding and budget management.

- The landscape includes the federal student loan portfolio, which details government-held student loan data.

Cost Metrics:

- Tools and calculators, such as those assessing the consumer price index and cost of living, aid in translating educational costs to contemporary economic conditions.

Tuition Trends:

- Institutional databases maintain records of housing costs and other expenses contributing to the cost of attendance.

Commonly Asked Questions

What is the Average Cost of a Bachelor's Degree?

The average cost of a bachelor's degree in the U.S. varies by type and location of the institution. For the 2022–2023 academic year:

- Public Four-Year In-State: Annual average is $27,940, totaling $111,760 over four years.

- Public Four-Year Out-of-State: Annual average is $45,240, totaling $180,960 over four years.

- Private Nonprofit Four-Year: Annual average is $57,570, totaling $230,280 over four years.

Including all expenses, the total annual costs are approximately:

- $26,027 at public in-state institutions ($104,108 over four years).

- $27,091 at public out-of-state institutions ($108,364 over four years).

- $55,840 at private institutions ($223,360 over four years).

Although a bachelor's degree typically takes four years, only about 40.4% of students finish in this time. Most complete within six years, with the six-year total cost averaging around $156,162.

Average Yearly Cost for a Bachelor's Degree

The typical yearly expense for acquiring a bachelor's degree spans a wide range, largely depending upon whether the institution is public or private.

On average, tuition and fees for a public four-year in-state institution may cost around $10,000 per year, while private colleges can average about $39,000 annually.

Semester-wise Tuition Breakdown for Undergraduate Courses

Undergraduate programs' tuition can fluctuate from semester to semester, with public two-year in-district colleges averaging around $3,860. Meanwhile, four-year institutions charge between $10,000-$39,000 per year, depending on residency and whether the college is public or private.

This breaks down to a substantial difference when considering per-semester costs.

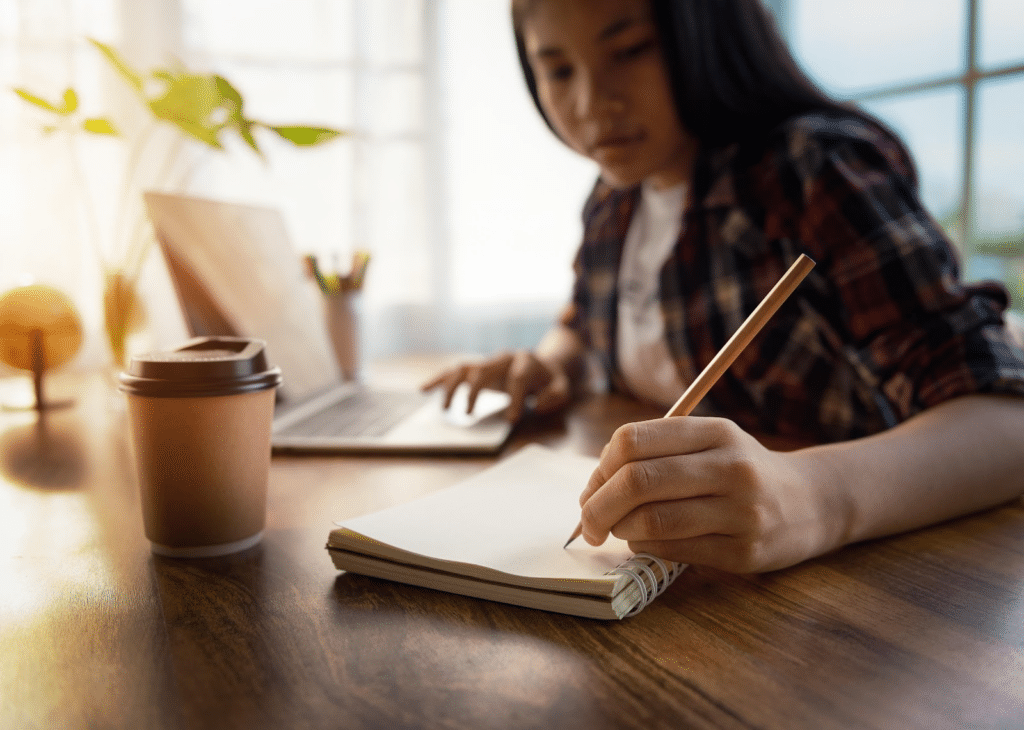

Monthly Expenditure Range for College Students

College students' monthly expenses, which can include housing, food, transportation, and textbooks, may range from $1,000 to $2,000. This estimate does not include tuition and varies significantly based on location and personal spending habits.

List of Average Tuition Rates Across College Types

- Public Two-Year College (In-District): $3,860

- Public Four-Year College (In-State): $10,940

- Public Four-Year College (Out-of-State): $28,240

- Private Four-Year College: $39,400

Influence of Financial Aid on College Costs

Financial aid, which includes scholarships, grants, and student loans, can substantially reduce the direct out-of-pocket expenses for college. The impact varies considerably by individual circumstances and can result in a wide range of net costs.

Expected College Expense Budgeting Throughout Academic Career

Students should account for tuition, fees, and living expenses when budgeting for college. Over four years, the cumulative costs can amount to an average of $146,000 at four-year institutions. Financial planning should also consider potential tuition hikes and personal expenses.

Average College Tuition Data Tables

Table 1: Overview of Average Cost of College

| Description | Cost (USD) |

|---|---|

| Average cost of college per student per year | $36,436 |

| Average growth rate over the past 10 years | 2% annually |

| Average in-state tuition (public 4-year) | $9,678 |

| Average out-of-state tuition (public 4-year) | $27,091 |

| Total annual cost (private, nonprofit 4-year) | $55,840 |

| Tuition part of total cost (private, nonprofit) | $38,768 |

| Ultimate cost of a bachelor's degree | Can exceed $500,000 |

Table 2: Annual Cost of College by Institution Type

| Institution Type | Cost of Tuition | Cost of Attendance |

|---|---|---|

| Public 4-Year In-State | $9,678 | $26,027 |

| Public 2-Year In-State | $3,501 | $3,439 |

| Private 4-Year Nonprofit | $38,768 | $54,840 |

| Private 4-Year For-profit | $17,825 | $32,895 |

| Private 2-Year Nonprofit | $17,735 | $33,007 |

| Private 2-Year For-profit | $15,637 | $27,214 |

Table 3: Total Cost of a Degree

| Institution Type | Total Cost of Tuition | Total Cost of Degree |

|---|---|---|

| Public 4-Year In-State | $26,027 | $156,162 |

| Public 2-Year In-State | $16,090 | $32,180 |

| Private 4-Year Nonprofit | $55,840 | $223,360 |

| Private 4-Year For-profit | $32,895 | $131,580 |

| Private 2-Year Nonprofit | $33,007 | $66,014 |

| Private 2-Year For-profit | $27,214 | $54,428 |

Table 4: Average Cost of Tuition

| Institution Type | Cost of Tuition and Fees | Percentage of Total College Costs |

|---|---|---|

| Any 4-Year Institution | $19,806 | 54% |

| Public 4-Year In-State | $9,678 | 37% |

| Private 4-Year Nonprofit | $38,768 | 69% |

| For-profit 4-Year | $17,825 | 54% |

| Any 2-Year Institution | $4,481 | 26% |

| Public 2-Year In-District | $3,970 | 24% |

| Private 2-Year Nonprofit | $17,735 | 53% |

| For-profit 2-Year | $15,637 | 57% |

Table 5: Historical Average Cost of Tuition

| Year | Tuition Cost (Public 4-Year) | Adjusted for Inflation |

|---|---|---|

| 1963 | $243 | $2,431.02 (as of 2022) |

| 1989 | $4,504 | -- |

| 2020-21 | $19,372 | -- |

| 2010-11 to 2020-21 Period | Average tuition increase: 45% (public 4-year), 28% (private nonprofit 4-year), 17% (2-year colleges) |

Table 6: Average Costs of Books, Supplies, Room & Board

| Description | Cost at Public 4-Year | Cost at Private Nonprofit | Cost at For-profit |

|---|---|---|---|

| Books and Supplies | $1,216 | $1,226 | $1,035 |

| Room and Board (on-campus) | $11,520 | $13,028 | $32,895 |

| Room and Board (off-campus) | $11,365 | $11,269 | $8,543 |

Table 7: Additional Annual Expenses for College Students

| Living Situation | Public 4-Year On-Campus | Public 4-Year Off-Campus | Private Nonprofit On-Campus | Private Nonprofit Off-Campus | For-Profit On-Campus | For-Profit Off-Campus |

|---|---|---|---|---|---|---|

| Additional Expenses | $3,304 | $4,551 | $2,818 | $3,304 | $5,268 | $4,506 |

Table 8: Most Expensive and Most Affordable 4-Year Private Nonprofit Universities

Most Expensive Universities

| Institution | Location | Tuition (USD) |

|---|---|---|

| Columbia University | New York, NY | $61,671 |

| Bard College at Simon’s Rock | Great Barrington, MA | $61,169 |

| Franklin and Marshall College | Lancaster, PA | $61,062 |

| Vassar College | Poughkeepsie, NY | $60,930 |

| Amherst College | Amherst, MA | $60,890 |

Most Affordable Universities

| Institution | Location | Tuition (USD) |

|---|---|---|

| Turtle Mountain Community College | ND | $2,250 |

| Curtis Institute of Music | PA | $3,015 |

| Grace Mission University | CA | $3,120 |

| Sioux Falls Seminary | SD | $3,600 |

| Universidad Pentecostal Mizpa | PR | $4,220 |

Table 9: Average Cost of Lost Income

| Time Frame | Potential Income Lost | Context |

|---|---|---|

| Weekly Income | $853 | For a high school graduate |

| Annual Income | $44,356 | Median annual income for high school graduates |

| Four-Year Earnings | $177,424 | Total potential income lost over four years of study |

Table 10: Average Cost of Borrowing for College

| Student Borrowing Statistics | Detail |

|---|---|

| Average Federal Student Loan Debt | $37,787.38 |

| Percentage of Students Borrowing Annually | 30.2% |

| Average Annual Borrowed Amount | More than $7,200 |

Table 11: Average College Costs by State

| State | In-State Tuition and Fees | Range of Costs |

|---|---|---|

| Most Expensive (Northeast) | Up to $14,740 | Most expensive public universities |

| Most Affordable (South, Plains) | As low as $6,529 | Most affordable public universities |

Analysis and Insights on College Education Costs

1. General Trends in Tuition Costs:

- College tuition costs continue to rise, with a notable increase in the 2023-2024 academic year across both public and private institutions. Despite these increases, when adjusted for inflation, there's a slight decrease in actual costs, suggesting that while nominal tuition rates go up, they may not outpace the general inflation rate significantly in some cases.

2. The Impact of Financial Aid and Scholarships:

- A significant portion of the sticker price at private colleges is often mitigated by financial aid and scholarships. For example, private nonprofit colleges reported an average estimated tuition discount rate of 56.2% for first-time, full-time freshmen, which indicates that the net price paid by students can be considerably lower than the advertised tuition rates.

3. Misconceptions About College Costs:

- There is a widespread underestimation of college costs among prospective students. A survey indicated that 1 in 4 high school students believed the total cost of attendance for one year of college to be $5,000 or less, highlighting a significant gap in financial literacy related to higher education expenses.

4. Disparities Between Public and Private Institutions:

- The cost of attending a public in-state institution is significantly less than attending a private institution. This cost differential highlights the importance of state funding and subsidies for education, which can make higher education more accessible to a larger population.

5. Long-Term Financial Impact:

- The ultimate cost of obtaining a bachelor’s degree, considering student loan interest and potential lost income, can exceed $500,000. This underscores the need for careful financial planning and consideration of return on investment when choosing an educational path.

6. Variability in Costs by Institution Type:

- There is considerable variability in tuition costs among different types of institutions. For instance, for-profit institutions tend to have lower tuition fees than private nonprofit institutions but might offer less financial aid and support, which can affect the total cost of education.

7. Geographic Variations in Tuition Costs:

- Tuition and fees vary significantly by state, with the most expensive public universities primarily located in the Northeast and the least expensive in the South and Plains regions. This geographic disparity can influence where students choose to apply and attend based on financial feasibility.

8. The Role of Additional Expenses:

- Beyond tuition, other expenses such as room and board, books, supplies, and personal expenses can add substantially to the cost of college. These costs need to be factored into the total budget for college, as they can vary widely depending on the location and type of institution.

9. Economic Context and Student Borrowing:

- Economic conditions and the borrowing landscape are crucial to understanding college costs. With a significant portion of students relying on loans, the conditions under which they borrow and repay these loans (interest rates, repayment terms) are pivotal in the overall affordability of higher education.

10. Policy Implications:

- The data suggests a need for enhanced financial literacy programs to better prepare students for the realities of college costs. Additionally, there may be room for policy interventions at both state and federal levels to control the rising costs of college and increase the transparency and accessibility of financial aid.

Sources