Online Colleges That Accept FASFA

Discover the best online colleges that accept FAFSA in 2025, offering affordable and accredited programs to fund your degree. EDsmart’s guide helps you apply for federal aid and find top schools, including cheap options and programs near you.

Online colleges provide flexible, accessible education for students managing busy lives, but tuition costs can be a challenge.

The Free Application for Federal Student Aid (FAFSA) offers federal grants, loans, and work-study programs to make online degrees affordable.

This EDsmart guide lists the best online colleges that accept FAFSA in 2025, featuring affordable (cheap) and regular options to suit various budgets and goals.

We also address “online colleges that accept FAFSA near me” with regional insights to connect you with state-specific aid and programs.

Whether you’re seeking the cheapest online schools or prestigious institutions, our expert advice helps you secure funding and start your degree. Apply for FAFSA now at studentaid.gov and explore top programs today!

- What is FAFSA and Why Does It Matter?

- How to Check if an Online College Accepts FAFSA

- Cheapest Online Colleges That Accept FAFSA

- More Online Colleges That Accept FAFSA

- Online Colleges That Accept FAFSA Near Me

- How to Apply for FAFSA

- Eligibility for Federal Financial Aid

- Other Financial Aid Options

- FAQ: Online Colleges and FAFSA

- Other Financial Aid Options for Online Students

- Conclusion

What is FAFSA and Why Does It Matter?

The FAFSA, administered by the U.S. Department of Education, determines eligibility for federal financial aid (FAFSA Application). Open from October 1 to June 30 for the next academic year, it unlocks:

- Grants: Free money, like Pell Grants (~$7,600 in 2025, estimated).

- Loans: Low-interest federal loans with flexible repayment.

- Work-Study: Part-time jobs to fund education.

In 2019-20, ~50% of undergraduates used federal aid, saving thousands compared to private loans (NASFAA). Choosing a FAFSA-eligible online college ensures access to these resources, reducing financial stress. Start your FAFSA application today to make your degree affordable (EDsmart Financial Aid Guide).

How to Check if an Online College Accepts FAFSA

Verify FAFSA eligibility before enrolling to secure federal aid. Here’s how:

- Check the Financial Aid Page: Look for FAFSA details on the school’s website (e.g., SNHU Financial Aid).

- Use the Federal School Code Search: Confirm eligibility by school name or code at studentaid.gov.

- Verify Accreditation: Only accredited schools qualify. Check the DAPIP database.

- Confirm Title IV Status: Ensure the school is listed in the Title IV spreadsheet at studentaid.gov.

- Contact the Financial Aid Office: Clarify with the school directly.

Caution: Schools like Penn Foster, Hill University, Columbus University, Atlantic University, and Ashworth College do not accept FAFSA due to non-standard accreditation (Sallie Mae). Verify now to choose a FAFSA-eligible program.

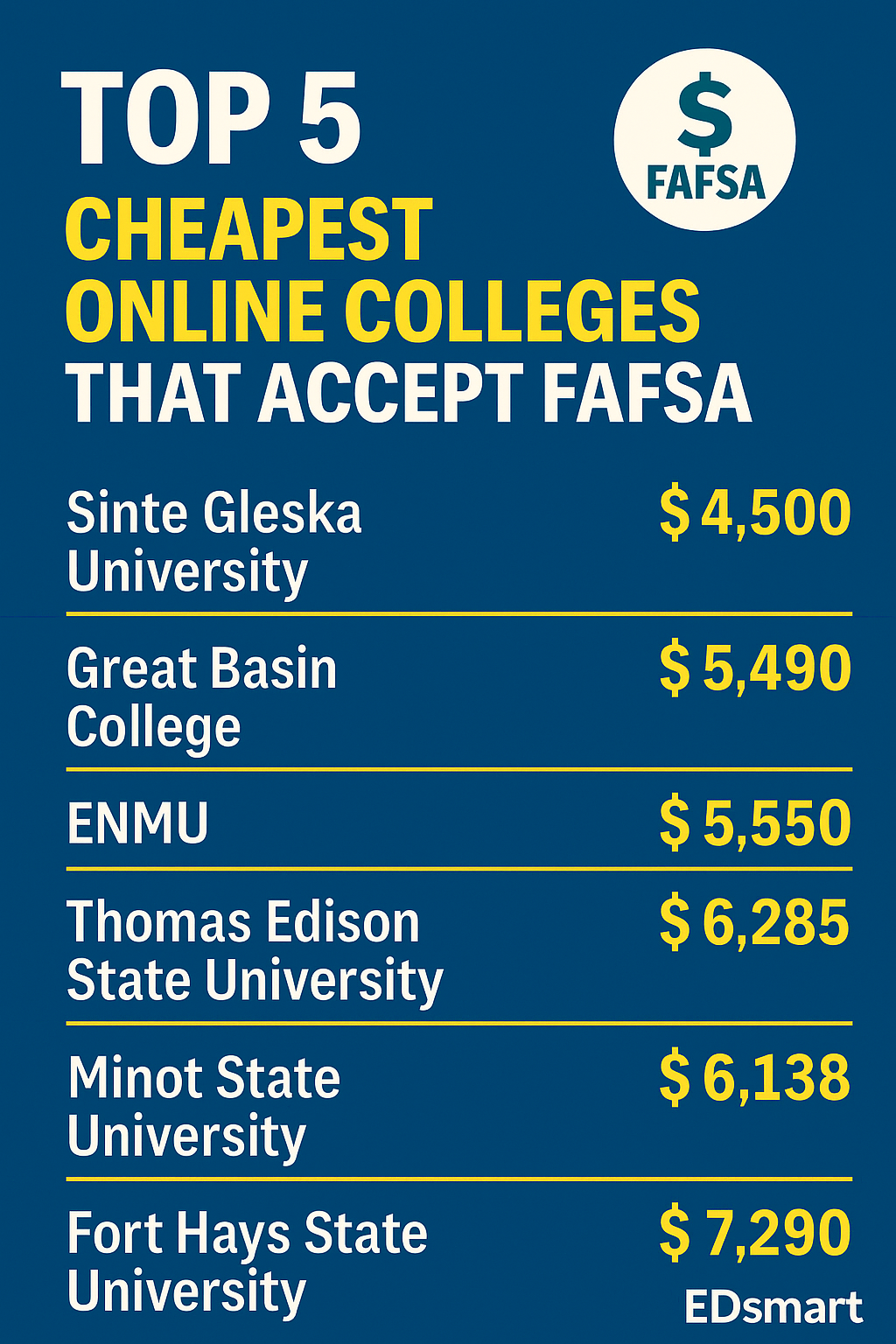

Cheapest Online Colleges That Accept FAFSA

These online colleges offer tuition under ~$10,000/year (or equivalent) and accept FAFSA, ideal for budget-conscious students. Tuition estimates for 2025 are adjusted for ~3% inflation from 2024 or sourced from recent data.

| College Name | Tuition (2025 Estimate) | Accreditation | Financial Aid Link | Notable Features |

| Western Governors University | $8,600/six-month term | Northwest Commission on Colleges and Universities | WGU Financial Aid | Flat-rate, self-paced, competency-based |

| Excelsior University | $510/credit (~$7,650/15 credits) | Middle States Commission on Higher Education | Excelsior Financial Aid | Flexible, transfer-friendly |

| University of Wisconsin-Platteville | ~$8,794/year (in-state) | Higher Learning Commission | UW-Platteville Financial Aid | Affordable, practical programs |

| American Public University | $315/credit (~$9,450/year) | Higher Learning Commission | APU Financial Aid | Low per-credit cost, military-friendly |

| Thomas Edison State University | $419/credit (~$6,285/15 credits) | Middle States Commission on Higher Education | TESU Financial Aid | Adult-focused, credit-by-exam options |

| Great Basin College | $183/credit (~$5,490/30 credits) | Northwest Commission on Colleges and Universities | GBC Financial Aid | Low-cost, Nevada-focused programs |

| Eastern New Mexico University | $185/credit (~$5,550/30 credits) | Higher Learning Commission | ENMU Financial Aid | Affordable, regional accreditation |

| Minot State University | $341/credit (~$6,138/18 credits) | Higher Learning Commission | Minot State Financial Aid | Low-cost, education and nursing focus |

| Fort Hays State University | $243/credit (~$7,290/30 credits) | Higher Learning Commission | FHSU Financial Aid | High-value, affordable degrees |

| Sinte Gleska University | $150/credit (~$4,500/30 credits) | Higher Learning Commission | Sinte Gleska Financial Aid | Native American-focused, low-cost |

Tuition Comparison Chart

Compare tuition costs for these affordable FAFSA-accepting colleges:

Explore affordable programs at these schools and apply for FAFSA to fund your education (studentaid.gov).

More Online Colleges That Accept FAFSA

These colleges offer diverse programs, sometimes higher tuition, or prestigious credentials, all accepting FAFSA, catering to students seeking quality or reputation.

| College Name | Tuition (2025 Estimate) | Accreditation | Financial Aid Link | Notable Features |

| University of Florida Online | $129.18/credit (~$15,501.60/120 credits) | SACSCOC | UF Financial Aid | High graduation rate (91%), top-ranked |

| Purdue University Global | $371/credit (~$13,356/36 credits/year) | Higher Learning Commission | Purdue Global Financial Aid | Career-focused, flexible |

| Kansas State University Online | ~$10,000/year | Higher Learning Commission | K-State Financial Aid | High acceptance rate (96%), practical focus |

| University of Maryland Global Campus | $324/credit (in-state), $499/credit (out-of-state) | Middle States Commission on Higher Education | UMGC Financial Aid | Extensive online offerings |

| Penn State World Campus | $671/credit | Middle States Commission on Higher Education | Penn State Financial Aid | Prestigious, wide program range |

| Southern New Hampshire University | $320/credit (~$9,600/30 credits/year) | New England Commission of Higher Education | SNHU Financial Aid | Over 200 programs, affordable |

| Capella University | $357-$415/credit (bachelor’s) | Higher Learning Commission | Capella Financial Aid | Flexible, career-oriented |

| Grand Canyon University | $18,000/year | Higher Learning Commission | GCU Financial Aid | Christian values, scholarships |

| Harvard University Extension | $2,100/course (~$25,200/12 courses) | New England Commission of Higher Education | Harvard Extension Financial Aid | Elite reputation, need-based aid |

| Colorado State University Online | ~$350-$500/credit | Higher Learning Commission | CSU Online Financial Aid | Strong regional presence, diverse programs |

| Arizona State University Online | $561-$661/credit | Higher Learning Commission | ASU Online Financial Aid | Innovative, over 300 programs |

| Strayer University | $335/credit (~$10,050/30 credits/year) | Middle States Commission on Higher Education | Strayer Financial Aid | Business, IT, education focus |

| University of Phoenix | $398/credit (~$11,940/30 credits/year) | Higher Learning Commission | Phoenix Financial Aid | Flexible, career-driven programs |

| Rush University Online | ~$1,000/credit | Higher Learning Commission | Rush Financial Aid | Health sciences, specialized programs |

| Saint Leo University Online | $410/credit (~$12,300/30 credits/year) | SACSCOC | Saint Leo Financial Aid | Catholic values, military-friendly |

| Columbia College Online | $375/credit (~$11,250/30 credits/year) | Higher Learning Commission | Columbia College Financial Aid | Affordable, diverse programs |

| Regent University Online | $395/credit (~$11,850/30 credits/year) | SACSCOC | Regent Financial Aid | Christian-based, leadership focus |

| Liberty University Online | $390/credit (~$11,700/30 credits/year) | SACSCOC | Liberty Financial Aid | Christian-based, over 400 programs |

| University of Illinois Springfield Online | $362/credit (~$10,860/30 credits/year) | Higher Learning Commission | UIS Financial Aid | Public university, strong online offerings |

| Bellevue University Online | $449/credit (~$13,470/30 credits/year) | Higher Learning Commission | Bellevue Financial Aid | Career-oriented, affordable programs |

Enroll today at these schools and apply for FAFSA to fund your degree (studentaid.gov).

Online Colleges That Accept FAFSA Near Me

The search term “online colleges that accept FAFSA near me” often reflects a desire for programs with regional accreditation or a physical presence in your state, which can offer benefits like state-specific financial aid or alignment with professional licensing (e.g., nursing, teaching). Online programs allow study from anywhere, but regional ties enhance access to local resources and aid.

Why Regional Schools Matter:

- State-Specific Aid: States offer grants or scholarships for residents at in-state schools, even online. For example, Florida residents at University of Florida Online may qualify for the Florida Student Assistance Grant (Florida Student Financial Aid).

- Licensing Requirements: Professions like education or healthcare often require degrees from regionally accredited schools for state licensure.

- Local Support: Nearby campuses provide access to libraries, advising, or career services.

How to Find Regional FAFSA-Eligible Colleges:

- Use College Navigator: Filter for online programs by state at College Navigator and verify FAFSA eligibility via studentaid.gov.

- Check Regional Accreditation: Confirm accreditation by regional bodies (e.g., SACSCOC, Higher Learning Commission) in the DAPIP database.

- Explore State Universities: Many state schools offer online programs with FAFSA eligibility and regional relevance.

- Contact State Education Agencies: Find approved online programs and state aid at agencies like California Student Aid Commission or Texas Higher Education Coordinating Board.

Regional Examples:

- Southeast (Florida, Georgia): University of Florida Online (UF Financial Aid) and Saint Leo University Online (Saint Leo Financial Aid) are SACSCOC-accredited with Florida ties. Florida residents may access the Bright Futures Scholarship.

- Midwest (Wisconsin, Kansas, Illinois): University of Wisconsin-Platteville (UW-Platteville Financial Aid), Kansas State University Online (K-State Financial Aid), and University of Illinois Springfield Online (UIS Financial Aid) offer affordable, regionally accredited programs. Wisconsin residents can apply for the Wisconsin Grant.

- West (Colorado, Arizona, New Mexico): Colorado State University Online (CSU Financial Aid), Arizona State University Online (ASU Financial Aid), and Eastern New Mexico University (ENMU Financial Aid) are strong options. Colorado residents may qualify for the Colorado Student Grant.

- Northeast (Pennsylvania, Massachusetts): Penn State World Campus (Penn State Financial Aid) and Harvard University Extension (Harvard Extension Financial Aid) provide prestigious programs. Pennsylvania residents can explore PHEAA grants (PHEAA).

- Plains (North Dakota, Kansas): Minot State University (Minot State Financial Aid) and Fort Hays State University (FHSU Financial Aid) offer low-cost, regionally accredited degrees.

- Tribal/Indigenous Communities: Sinte Gleska University (Sinte Gleska Financial Aid) serves Native American students with affordable, FAFSA-eligible programs.

Action Step: Find schools near you using College Navigator and apply for state aid through your state’s education agency (EDsmart State Aid Guide).

How to Apply for FAFSA

Secure federal aid for your online college with these steps:

- Gather Documents: Social Security number, driver’s license, tax returns, financial records.

- Create an FSA ID: You and your parents (if dependent) need one at studentaid.gov.

- Submit FAFSA: Complete online at studentaid.gov or via PDF by June 30. Apply early (October 1) for maximum aid.

- Review Student Aid Report (SAR): Check your SAR for errors and correct online.

- Accept Aid: Follow your school’s financial aid office instructions, sign promissory notes for loans, and complete entrance counseling.

Pro Tip: Apply early to access limited funds like FSEOG (Federal Student Aid). Start your application now for 2025 aid.

Eligibility for Federal Financial Aid

To qualify for FAFSA, you must:

- Be a U.S. citizen or eligible non-citizen.

- Have a valid Social Security number.

- Demonstrate financial need (for need-based aid).

- Be enrolled in a FAFSA-eligible, accredited program.

- Hold a high school diploma or GED.

- Maintain satisfactory academic progress.

Disqualifiers:

- Defaulting on federal loans.

- Owing grant refunds.

- Misusing aid funds.

- Attending non-accredited schools.

- Certain criminal convictions (some exceptions apply).

Check full criteria at Federal Student Aid (Research.com).

Other Financial Aid Options

Beyond FAFSA, explore:

- Scholarships: Merit- or need-based awards from schools or organizations (WGU Scholarships).

- Grants: Federal (Pell, FSEOG) or state grants (Federal Student Aid).

- Loans: Federal loans offer lower rates than private (Sallie Mae Loans).

- Work-Study: Part-time jobs at schools like CSU Online (CSU Financial Aid).

- Employer Tuition Assistance: Check with your employer for benefits.

- Military Benefits: GI Bill or tuition assistance for veterans (WGU Military).

- Loan Forgiveness: For healthcare, education, or public service careers (Student Loan Planner).

Estimate aid with the Federal Student Aid Estimator and find scholarships at Bold.org.

FAQ: Online Colleges and FAFSA

Does FAFSA cover online classes?

Yes, FAFSA covers online classes at accredited, Title IV-eligible schools (Federal Student Aid).

What online colleges accept FAFSA?

Accredited schools like Western Governors University, Purdue University Global, and Harvard Extension accept FAFSA. Check eligibility at studentaid.gov (Sallie Mae).

Can I use FAFSA for online college?

Yes, for accredited, Title IV-eligible programs (Federal Student Aid).

What are the cheapest online colleges that accept FAFSA?

Sinte Gleska University (~$4,500/year), Great Basin College (~$5,490/year), and Western Governors University ($8,600/term) are top picks (Bold.org).

Do online schools accept Pell Grants?

Yes, FAFSA-eligible schools accept Pell Grants (College Consensus).

Does Penn Foster accept FAFSA?

No, Penn Foster does not qualify for FAFSA (Sallie Mae).

What are the best online colleges that accept FAFSA?

Harvard Extension (prestige), Purdue Global (career focus), and WGU (affordability) stand out (Scholarships360).

How do I find online colleges that accept FAFSA near me?

Search by state at College Navigator and verify FAFSA eligibility at studentaid.gov. Try state schools like Colorado State University Online (CSU Financial Aid).

Other Financial Aid Options for Online Students

There are other ways to finance your schooling for students whose schools don't provide FAFSA, or if a student doesn't qualify for financial aid.

- Scholarships: Free money awarded based on academic merit, extracurricular activities, or financial need. Students should apply for as many as they are eligible for.

- Grants: Free money awarded based on financial need. Students do not have to repay them.

- Loans: Borrowed money that must be repaid with interest. Students should compare interest rates and repayment terms before choosing a loan.

- Work-study: A program that allows students to earn money for college by working part-time jobs on campus or in the community.

- Employer tuition assistance programs: Some employers offer programs that cover a portion of tuition costs.

- Military benefits: If students are military members or veterans, they may be eligible for tuition assistance, scholarships, or grants to help pay for college.

Conclusion

FAFSA makes online education affordable by funding accredited programs at budget-friendly and prestigious colleges. From the cheapest options like Sinte Gleska University to regular programs at Harvard Extension, this guide helps you find FAFSA-eligible schools for 2025.

For “online colleges that accept FAFSA near me,” regional schools offer state aid and licensing benefits. Take action today: apply for FAFSA at studentaid.gov, explore programs above, and enroll in your ideal college to start your degree with EDsmart’s guidance.